Virtually everybody not living under a rock is by now aware of the existence of Bitcoin (“BTC”), the biggest cryptocurrency, with US$100 billion total market value as of the time of this writing, although probably a majority of people has no deep understanding of what it is and how it works, as evidenced by remarks such as those recently made by the CEO of a major global bank. The set of people familiar with Ether, the No. 2 cryptocurrency by value (currently US28 billion), will be significantly smaller, with even fewer people understanding its workings, specifically the Ethereum framework of which it is a vital part. This article sets out to provide a brief overview of Ethereum, including discussion of a potential valuation framework. Based on the underlying fundamental attractiveness of Ether as well as the fact that its inclusion in soon-to-come passive cryptocurrency investment products is virtually guaranteed by its no. 2 status by market capitalization, investors may well consider starting to accumulate a position.

The origin: Bitcoin and the blockchain

Like Bitcoin, Ether is essentially a digital asset that lives as a credit position on a decentralized ledger — just imagine a giant Excel sheet that shows who owns which bitcoins — called the blockchain.

Only that the blockchain is far safer than the hypothetical Excel sheet. The latter could be hacked/manipulated and it may be enough to just change one or several cells in order to alter Bitcoin ownership. Not so on the blockchain – as the “chain” part of its name implies, there is a chain here, specifically a cryptographically linked chain that, for each bitcoin, shows its transaction path (i.e. how it got into the current owner’s hands) going back to the origin of the coin, i.e. the time of its mining (which, at the extreme, could be the very beginning of BTC, the so-called ‘genesis block’). If one just altered the latest block, or any part for that sake, of the blockchain, its cryptographic calculations would not ‘check out’ anymore. Going back to the Excel sheet comparison – one would have to alter the entire sheet, not just one or a couple of cells. However, that is not the end of it: extending the blockchain (“mining a new block”, in our comparison equivalent to updating the hypothetical Excel spreadsheet) requires a computational problem to be solved, which in turn requires a significant amount of computations which in turn requires a significant amount of energy (at least in the case of the BTC blockchain, and this is not an uncontroversial point from an environmental point of view, by the way). The BTC blockchain is by now almost half a million blocks long and “rewriting” that entire blockchain is, for all we know, computationally infeasible (quantum computing may change that, but not with currently known algorithms). The other part of the safety aspect of the blockchain is that it is decentralized, i.e. there is no central authority controlling it (like if there was an owner of the hypothetical spreadsheet). The more detailed elements, including game theoretical considerations, of this decentralized consensus mechanism exceed the scope of this article – suffice to say that there is one important assumption here that no malicious party will ever control over 50% of the BTC network and that the basic rule is that the longest blockchain in existence is taken to be the “true” one. For further discussion, start with the original BTC white paper.

For those not familiar with BTC in detail, it is important to point out at this point that security breaches that you have heard of with regard to BTC have never been issues with the actual blockchain, but rather attacks on other parts of the BTC ecosystem, especially BTC exchanges.

So, in summary, the genius of the blockchain is that you have a tamper-proof (for all we know), decentralized database, the updating process of which is ‘trustless’ (in that you do not have to trust a central owner).

Hopefully some will now ask the obvious question: “…but wait, is there not so much more you can do with databases rather than just track coin holdings? Are databases not at the core of many, maybe most, businesses?”

Enter Ethereum

I am glad you asked. Vitalik Buterin, who proposed Ethereum in late 2013, thought so, too. The BTC blockchain basically just vets bitcoins passing from one owner to another, a ‘state transition’ in computer science speak, and a very specific one. Ethereum proposes a decentralized architecture that could handle much a much broader class of, including much more complex, state transitions. That might sound very abstract, so let us just review a couple of examples.

Actually, let just start by reviewing the simple state transition on the BTC blockchain: when the BTC network receives a new instruction (“transaction” in Ethereum speak) to pass 1 BTC from party A to party B, then execute this state transition IF (I) party A actually has (at least) 1 BTC and (ii) the cryptography checks out.

Now let us complicate that basic scenario: the transaction now is to pass 1 Ether from party A to party B IF (I) party A actually has (at least) 1 Ether, (ii) it rained in Zurich today and (III) the cryptography checks out. Congratulations, you just invented a weather derivative on Ethereum.

In example 2, the transaction is to pass 1 Ether from party A to party B for every hour that party A uses a specific car owned by party B. Congratulations, you are well on your way to having put a car sharing service (like Zipcar) onto Ethereum.

By now you probably have a grasp of what is going on and may think of other examples. In fact, it is testament to the attractiveness of the Ethereum platform that people have already thought about a whole lot of things that could be done on it, including e.g. from file storage all the way to “DAOs”, decentralized autonomous organizations.

Before going on, we have to circle back to two questions that should have come up by now.

First, why do we simply not do all of these things on the existing BTC blockchain? The simple answer is that the BTC blockchain was never designed to handle anything much more complex than passing BTC around, it lacks basic computational flexibility – in computer science speak, it is not “Turing complete.” However, some relatively simple things can be done on the BTC blockchain and, in fact, there are some simple crypto assets that can run on the BTC blockchain, notably colored coins.

Second, looking at the two above examples, how does the Ethereum network know whether it rained in Zurich or whether party A is using one of party B’s cars? The answer is, as you probably imagined via internet-connected sensors. Yes, that is right – the “internet of things” (IOT). So, in this way, Ethereum is also a major play on IoT. Strictly speaking, one could also use human input to the state transition function, but that would introduce subjectivity and thereby lower safety. As an example, imagine an Airbnb on Ethereum: after the guests of a rented apartment leave, usually a human goes in to check the state of the apartment, including to see whether anything is missing or broken. That could probably in theory be done by a large enough array of specific sensors (like hotels that do now often use sensors to check the contents of the minibar rather than humans) but it just does not seem very practical for now. From my experience, most investors in Ethereum-based businesses prefer business models that can be run without human inference.

A key feature of the Ethereum framework is that the computations necessary to perform the transactions are NOT free. One has to pay for them in, you guessed it, Ether. One pays a defined price (the “gas price”) per computational step.

So, in summary so far, we have a framework (Ethereum) that allows highly innovative economic activity to take place and that is ‘lubricated’ by its own currency (Ether). This sounds to me almost like a highly innovative country, where things like good infrastructure allow interesting, innovative economic activity to take place and where that activity is also lubricated by a currency – like e.g. Switzerland and its Franc (hence this section’s title) or South Korea and its Won. It is probably adequate that the Ethereum Foundation is based in Zug, Switzerland (by now known as “Crypto Valley” due to the agglomeration of crypto companies there).

These characteristics make Ether quite different from BTC, which is essentially a pure store of value for now. There is nothing else one can do with BTC on the BTC blockchain except hold it or pass it around (i.e. use as a means of exchange). The means-of-exchange use case has not taken off yet in any meaningful way – there are fewer merchants accepting BTC at the time of this writing as in 2014 – and there are valid doubts that it ever will. So, BTC for now is essentially a pure store of value, just like Gold (which also is not really used as a means of exchange, at least not frequently and in most parts of the world – I, personally, do not remember ever paying anything in gold). BTC is actually more of a store-of-value pure-play than even gold, as the latter has some industrial use cases (see below), whereas BTC has none – you cannot even make jewelry out of it!

Some people compare Ether to silver, saying that, besides its use as a store of value, its use to buy gas to make computations on the Ethereum network essentially give it an industrial use that also serves as a value backstop. Silver is used e.g. in jewelry, electronics and medical applications (one of its main uses in the past was also in photographic film, but those days are gone, of course). Gold, too, besides jewelry, finds some use in electronics and medicine (incl. dentistry). The key difference I see between silver (and gold) and Ether is that the metals are not part of larger ecosystem, where that ecosystem can promote their value – in other words, there is no network effect with the metals with regard to their industrial use cases: they do not become more valuable because more people use them (a network effect would exist if they were adopted as means of payment). Ether, on the other hand, should experience more demand as more applications run on the Ethereum network.

Valuation framework

Understanding demand sources also brings us halfway to the discussion of a potential valuation framework for Ether, with the other half being its supply.

Here, too, Ether differs from BTC. Whereas the latter is limited by its protocol to a maximum number of just under 21 million coins, Ether continues to be issued, currently at a fixed absolute rate per year. As Ethereum is expected to soon switch its decentralized consensus mechanism from “proof-of-work” to “proof-of-stake” (details exceed the scope of this article), the future issuance is not entirely clear but currently expected to show 0.5-2% supply growth (i.e. inflation). A small, steady increase in monetary supply that Milton Friedman would approve! The current supply of Ether, by the way, is some 95.8 million.

This gives you the key ingredients to think about price determination by supply and demand – supply as just discussed, and on the demand side we have demand for Ether as a transaction currency and demand for Ether as a store of value.

Starting with the seemingly simpler one – for demand as a store of value, one can think about how much of global assets currently held in other stores of values (e.g. gold, silver, cash deposits) could realistically move into Ether. I have discussed this in more detail in another article with regard to BTC, where, as mentioned above, I see store-of-value demand as the only meaningful source of demand. In that article, I peg the amount of relevant global investable wealth (a combination of private banking assets and deposits) at around US$63 trillion and assume that, if BTC ‘works out’, a few percent of that wealth could end up in BTC – the corresponding proportion for Ether would probably be much lower, but that is a big assumption and a lengthy discussion.

With regard to demand as a currency for transactions, one has to think about which businesses could conceivably move onto Ethereum and in what size, what part of their revenues and/or costs would run on Ether, etc. This first question is not a trivial one and indeed many people who are critical of Ethereum and Ether point to the current scarcity of working use cases. A couple of recent examples are:

- Innogy SE, a subsidiary of German energy giant RWE, announced in May 2017 that it had launched hundreds of blockchain-powered charging stations for electric cars across Germany through its e-mobility startup venture Share&Charge.

- French insurer Axa announced in September 2017 that it had launched Fizzy, a flight delay insurance powered by smart contracts on the Ethereum blockchain, thereby automating claims analysis and processing and taking the human element out of the equation.

The bull case for Ether is clearly built on the expectation that human ingenuity will invent ever more such use cases. This is already happening – new projects are being proposed every day and many try to raise money via initial coin offerings (NYSE:ICO), executed via Ethereum (more on that below). In reality, one has to take a step back and check whether a proposed business model actually needs to run on a blockchain or whether an ‘old-fashioned’ centralized database approach is not sufficient or even better. This is a case-by-case analysis, but valid use cases are e.g. some where the blockchain eliminates counterparty risk (the Axa flight insurance is an example of this) or where it takes highly sensitive data out of the hands of centralized control. The bear case for Ethereum, by the way, is then that there are too few valid use cases and, furthermore, that full elimination of counterparty risk is not even possible – as this would require the smart contract code to be truly immutable, which, however, may not be practical as unexpected bugs in the smart contract (and/or even in the underlying Ethereum framework) make it desirable that somebody, somehow has the capability of altering the smart contract code. You can sense that his is a longer discussion – and it would exceed the scope of this article.

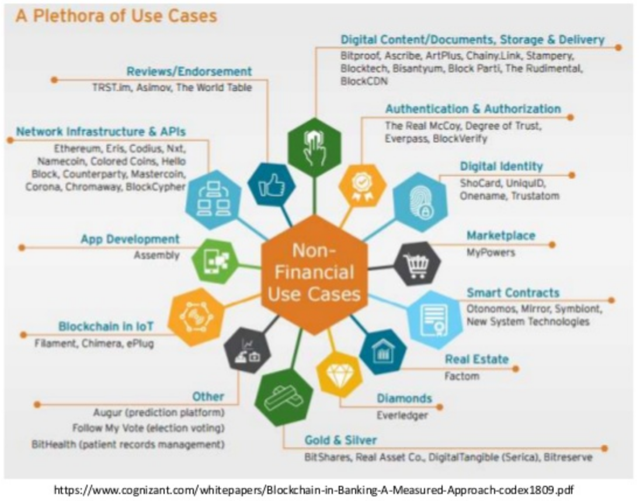

Here is a third-party chart given an overview of prominent use cases for the blockchain:

Now back to the most common use case for Ethereum to date: start-ups effecting crowdfunding via the Ethereum blockchain, issuing so-called ERC-20tokens in exchange for hard cash (typically in the form of cryptocurrencies). In an ideal world, the start-up issuing the token pursues a business model that is a legitimate use case of the blockchain (as discussed above) and the token issued will become an integral part of the business. In reality, this is probably not always the case and at least some issuers have taken advantage of the hype surrounding ICOs and their (for now) lack of regulation in order to raise money in a quick and easy way. Be that as it may, there is now an ever-increasing number of ICOs and the total raised in 2017, as of October, exceeds US$3 billion. There might well be a legitimate use case here, permanently taking a chunk away from the venture capital sector that would have otherwise funded at least part of this financing demand. ICOs are a fascinating topic by themselves and merit a separate blog post.

Now back to the most common use case for Ethereum to date: start-ups effecting crowdfunding via the Ethereum blockchain, issuing so-called ERC-20tokens in exchange for hard cash (typically in the form of cryptocurrencies). In an ideal world, the start-up issuing the token pursues a business model that is a legitimate use case of the blockchain (as discussed above) and the token issued will become an integral part of the business. In reality, this is probably not always the case and at least some issuers have taken advantage of the hype surrounding ICOs and their (for now) lack of regulation in order to raise money in a quick and easy way. Be that as it may, there is now an ever-increasing number of ICOs and the total raised in 2017, as of October, exceeds US$3 billion. There might well be a legitimate use case here, permanently taking a chunk away from the venture capital sector that would have otherwise funded at least part of this financing demand. ICOs are a fascinating topic by themselves and merit a separate blog post.

So, how much business could really move onto the blockchain? I must admit I have no clear answer yet, but it is another key assumption to make in the valuation framework. Once you have that number, you also need to think about how frequently the Ether monetary stock gets turned over, being used in the transactions. As for any currency (and by now it should be clear that Ether really is a currency, more than BTC, which is more like a commodity), you can then use the monetary equation of exchange MV=PY (where M is the monetary stock, V the velocity of money, P the price level and Y the real GDP). As a point of reference, the velocity in developed economies like the Eurozone, Japan or U.S. is between 1 and 2. It is important to remember, inter alia, that demand for a currency as a store of value depresses velocity.

Investment positioning

If you come to the conclusion, like me, that based on reasonable assumptions, Ether could have attractive long-term value, how can you invest? Unfortunately, there are no access products yet like OTCQX:GBTC for Bitcoin. However, being the no. 2 cryptocurrency by market capitalization, it is almost certain to be included in any future passive investment products for cryptocurrencies. For the same reason, if investment banks start making markets in cryptocurrencies and/or exchanges like the CME decide to add derivatives on cryptocurrencies (as the CME has just announced with Bitcoin), Ether will also likely be included. All these things would act as sources of additional demand. If you wanted to position yourself prior to those potential catalysts though, you can buy Ether directly on any of the big cryptocurrency exchanges such as e.g. Coinbase or Kraken.

Hopefully this article was able to give you a primer on what Ethereum is, how it is different from BTC and how valuation may be approached. Above all, I hope it opened your eyes to a potentially exciting new world of smart contracts (incl. their connection to the internet of things).

Disclosure: I am/we are long Ether.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

By: Raphael Rottgen

https://seekingalpha.com/article/4126096-ethereum-2-cryptocurrency-like-currency-innovative-country